Employee Business Expenses 2024 Deduction – Ready or not, the 2024 tax filing season is here. As of January 29, the IRS is accepting and processing tax returns for 2023. The agency expects more than 128 million returns to be filed before the . While simple math errors don’t usually trigger a full-blown examination by the IRS, they will garner extra scrutiny and slow down the completion of your return. So can entering your Social Security .

Employee Business Expenses 2024 Deduction

Source : www.freshbooks.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

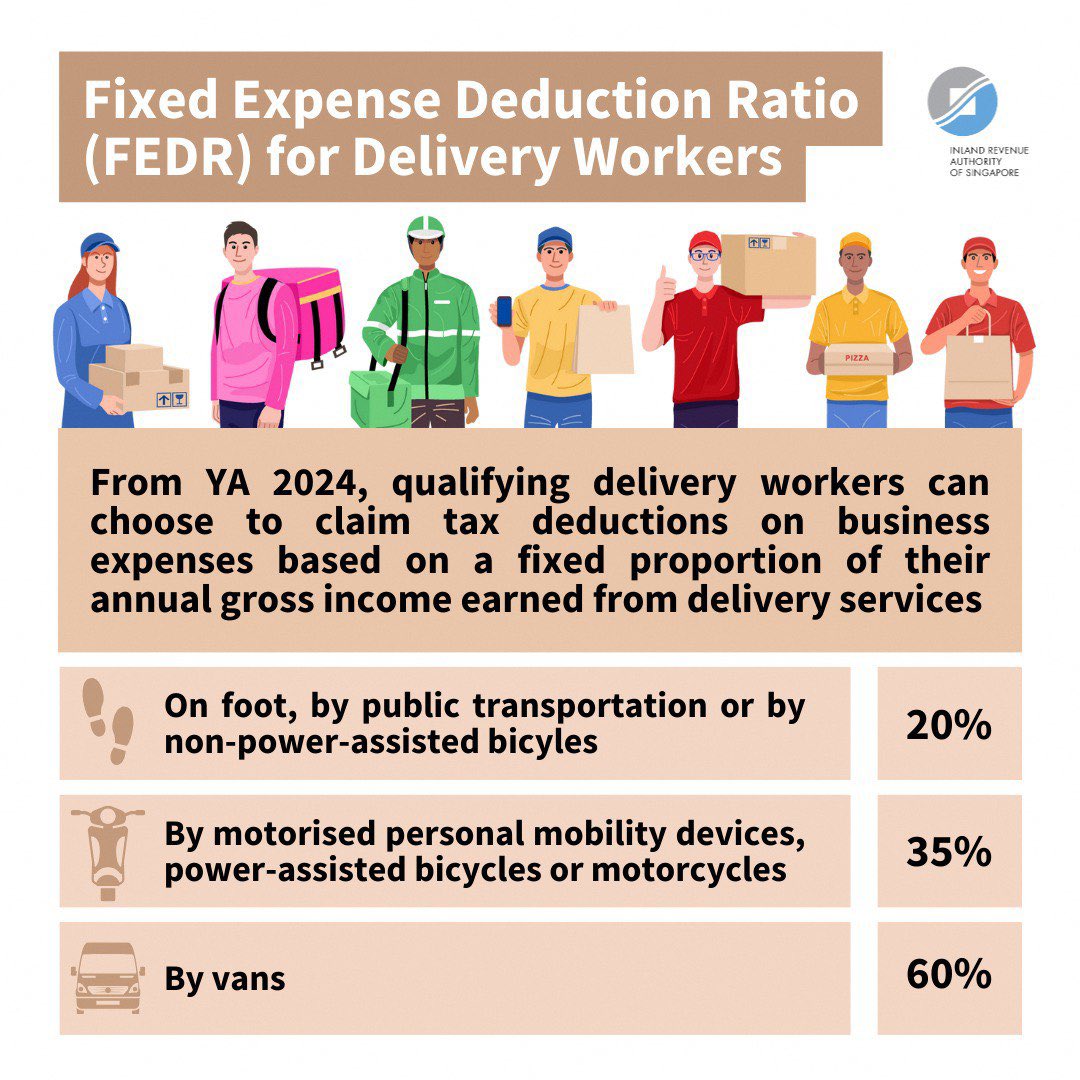

Source : quickbooks.intuit.comIRAS on X: “Good news for delivery workers! 🙌🏻 With effect from

Source : twitter.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comTodd Harrison on X: “🇺🇸 #cannabis 🌿 https://t.co/LEN9R7xeqK” / X

Meal and Entertainment Deductions for 2023 2024

Source : ledgergurus.comDeducting Meals as a Business Expense

Source : www.thebalancemoney.comSelf Employment Tax Deductions and Benefits 2024 Absetax

Source : absetax.comMcDaniel & Associates, P.C. | Dothan AL

Source : www.facebook.com19 Tax Deductions for Independent Contractors in 2024

Source : www.deel.comEmployee Business Expenses 2024 Deduction 25 Small Business Tax Deductions To Know in 2024: To be entitled to deduct home-office expenses, you must be required to use a part of your home for work. The CRA has confirmed that the requirement to maintain a home office need not be part of your . Employees who worked from home by choice last year under an agreement with their employer will be able to claim employment expenses on their tax return, the CRA says. Typically, an employee must be .

]]>

:max_bytes(150000):strip_icc()/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)